The Role of Latency in Forex Trading and How VPS Can Help – In the world of Forex trading, every second counts. Traders strive to capitalize on minute price movements, making split-second decisions that can spell the difference between profit and loss. In this high-stakes environment, latency emerges as a critical factor influencing trading outcomes. Understanding the role of latency and leveraging Virtual Private Servers (VPS) can significantly enhance a trader’s edge in the Forex market.

What is Latency?

Latency refers to the time it takes for data to travel between its source and destination. In the context of Forex trading, latency represents the delay between the moment a trader initiates a trade and when that trade is executed. This delay can occur due to various factors, including the physical distance between the trader’s device and the trading server, network congestion, and processing time within the trading infrastructure.

The Impact of Latency on Forex Trading

In the world of Forex, where market conditions can change rapidly, even a slight delay in trade execution can have significant consequences. Latency can lead to missed trading opportunities, slippage, and ultimately, reduced profitability. Consider a scenario where a trader identifies a favorable price movement and attempts to enter a trade. If latency causes a delay in the execution of that trade, the market may have already moved, resulting in an entry at a less favorable price or even a missed opportunity altogether.

In highly volatile market conditions or during major economic announcements, latency can exacerbate these issues, potentially amplifying losses or preventing traders from capitalizing on sudden price fluctuations.

Leveraging VPS to Reduce Latency

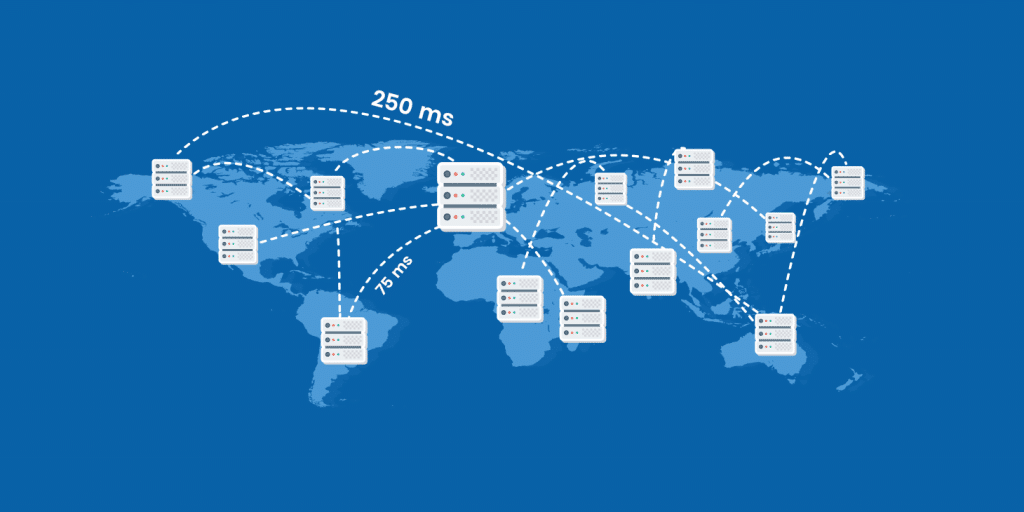

Virtual Private Servers (VPS) offer a solution to mitigate the impact of latency on Forex trading. A VPS is a virtual machine hosted on remote servers, providing traders with a stable and high-speed internet connection, as well as proximity to trading servers.

By utilizing a VPS, traders can significantly reduce the latency associated with trade execution. VPS providers typically offer servers located in close proximity to major trading hubs, minimizing the physical distance data needs to travel. Additionally, VPS systems are equipped with high-performance hardware and dedicated internet connections, further optimizing trade execution speeds.

In the dynamic world of Forex trading, where speed and precision are paramount, understanding the role of latency is crucial for success. By recognizing the impact of latency on trade execution and leveraging Virtual Private Servers (VPS), traders can gain a competitive edge in the market. With faster execution times, enhanced stability, and improved accessibility, VPS technology empowers traders to navigate the complexities of Forex trading with confidence and efficiency.

For traders seeking to achieve the best possible latency, FXVPS offers a solution with as low as 0.38 milliseconds latency for their broker. With our cutting-edge infrastructure and dedicated support, we are committed to optimizing your trading experience and helping you stay ahead of the competition. Explore the benefits of FXVPS today and unlock the full potential of your trading strategy.